By Jochen Sproll, Business Development Manager, Koenig & Bauer Durst

How digital transformation is powering enhanced customer experience and revenue growth

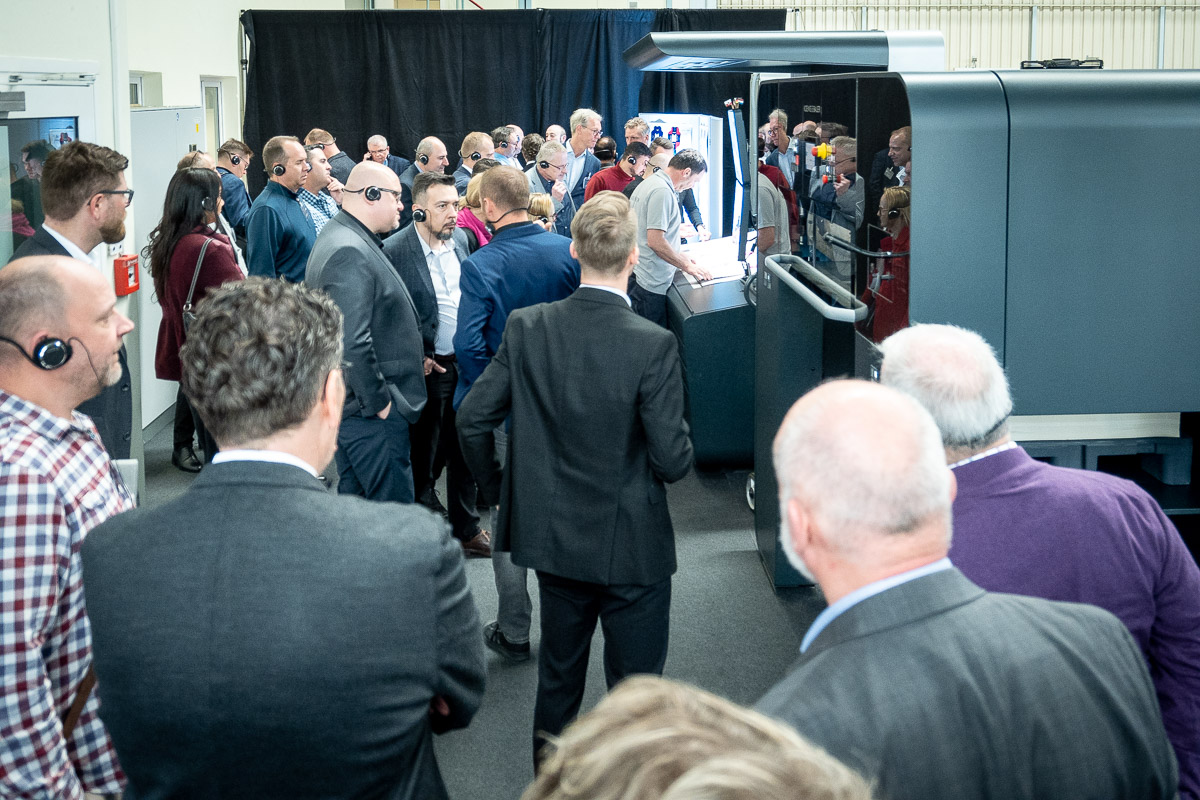

Industry innovators are always in for a highly educational, informative and inspirational SPC Open House at the Durst Innovation Center East in Lienz, Austria. We always want to ensure that the content is both fresh and with latest ‘news’, both from ourselves and for the industry in general.

Our last event had a focus on “Digital Transformation in Corrugated Packaging”. It explored key drivers shaping production demand. It considered, too, how digital technology responds in an agile and flexible way while also ensuring cost efficiency.

Attendees were told how demand for digital printing in packaging is growing in response to the proliferation of SKUs, increased interest in regionalization, enhanced product life cycle management, and the ability to keep pace with the ever-changing regulatory environment.

The result is the need to produce more jobs per day, meet faster turnaround times, deliver shorter run lengths, and manage planning complexity. There is also greater expectation for food safety and circular economy capabilities.

Digital production aids profitability with lower costs for shorter runs, optimised production, reduced waste, and obsolescence. It also requires less working capital and future-proofs production with water-based inks. It elevates customer experience and revenue growth via optimised print and total costs while delivering improved value for the customer.

This is partly due to existing and new trends bringing run lengths down (currently the average run length is 5,000 to 6,000 sqm), better utilization of conventional technology, and clearer total cost of ownership calculation of existing production volume to explore whether an investment will pay off.

For example, when comparing SPC to flexo, the break-even was found to be between 6,500 and 8,500 sqm. Digital printing was cheaper to produce and increased overall production output by 50% and productivity by 25%. The cost saving on digital addressable volume was €2.5m and the payback on the investment in SPC technology was two to three years.

Digital’s ability to focus on automation and standardization of processes with few touch points aids the understanding and optimization of the total cost of supply chain for customers. The streamlined workflow powers smooth operation and delivers a number of production gains:

- Shorter lead times and faster reaction times.

- Less complexity with the elimination of the plate process.

- Process waste saving equals 160k sqm of board saved.

- Ability to use a thinner top-liner equals 15% savings.

- No need to manage set up for design changes.

Digital production supports a collaborative, close working, customer experience with brands. Its ability to produce new test packaging, designs and campaigns quickly enables a better understanding of marketing objectives. It allows the cost effective production of smaller batch sizes and eases the move to supply chain management and partnership (different pricing models based on value of supply chain costs and not volume of boxes produced).

There is also the greater possibility of expanding a brand’s added value applications. In fact, 50% to 80% of volume over time is for new added value applications in the Koenig & Bauer Durst customer base. They include mass customization, sequential barcodes, new product offerings on uncoated board and, as mentioned before, test and promotional packaging.

Kärcher, known for its high-pressure cleaners, is one international brand that has moved the majority of its printing requirements to digital. In 2022, 52% of its jobs were digital compared to just 1% in 2015. As a result, it now benefits from simple data handling with pre-press, uniformed colour consistency, time savings in production without additional costs for printing plates, decreased quantities but increased variants and frequent layout changes due to constantly legal requirements.

Enabling brands to make this transition are operations like Schumacher Group. The family-managed company with sites across Europe registered a record month for production on its Delta SPC 130 in March 2022. In 28 days the press completed 226 jobs and printed 1,346,954.56 sqm. 73% jobs were produced without primer.

Koenig & Bauer Durst supports operations such as Schumacher with comprehensive prepress training (profiling, ink saving, embellishment), operator training (press efficiency, quality, maintenance), sales training (application training, product offerings), business knowledge transfer and a proven technology with most automated, productive, single pass water-based presses suitable for food packaging.

Koenig & Bauer Durst also delivers responsive service and customer care with remote diagnostics and telephone service as well as software and workflow support to ensure highest level of uptime.

Talk to Koenig & Bauer Durst or its partners discover more about how to introduce these business benefits, and more, by transitioning to digital production.

Make sure our next SPC Open House in Lienz on 27-28 September is in your diary!